Core Purpose

To Generate Exceptional Alpha through a Quantitative Investment approach, ensuring that every decision is data-driven and without any human biases.

Benefit of Our Quant Investing Framework

“Our Endeavour is to have that 80%+ of our portfolio remains in the ADD and HOLD categories.”

Super Performers

- ATH Price

- ATH Profit

- Outperformance relative to BSE 500

Performers

- ATH Profit

- Outperformance relative to BSE 500

- Stock Above Turtle Exit Price

Under Performers

- ATH Profit

- Outperformance relative to BSE 500

- Stock Above Turtle Exit Price

Benefit of Our Quant Investing Framework

“Our Endeavour is to have that 80%+ of our portfolio remains in the ADD and Hold categories.”

SuperPerformers

- ATH Price

- ATH Profit

- Outperformance relative to BSE 500

Performers

- ATH Profit

- Outperformance relative to BSE 500

- Stock Above Turtle Exit Price

- ATH Profit

- Outperformance relative to BSE 500

- Stock Above Turtle Exit Price

Ethos of Turtle’s Quant Process

Made with 20 Years of Experience by Rohan Mehta (CEO & Portfolio Manager)

Extremely Simple and fuelled with Speed

We know when to Hold, Run, Fold or Walk Away.

To Hold North, To Sell South & To Replace East & West Stocks

We Love our Clients Profit more than the Invested Companies

PPP Investment ProcessTM

Price

- Stocks at All Time High Price

- Outperformance at All Time High

- Deciding EXIT before ENTRY

Profits

- Profits at All Time High

- Turnaround Businesses

- Leadership/ Emerging Company

People

- Meeting Management

- Scuttlebutt Research

- Due Diligence

5 Crazy Features of Turtle's Quant Process

Turnaround

Business

Top 750 Companies of India

Outperformance of Stock to BSE 500

EXIT (Downside) is decided before ENTRY

Portfolio Allocation based on Risk Parameters

Turtle Quant-Driven Investment Principles

1

No Minimum Holding Bias

2

No Investing in SIN Business

3

No Sector Bias

4

No Market Cap Bias

5

No Model Portfolio Allocation Bias

6

No Averaging Loser

7

No Premature booking profits

8

No Falling In Love With Stocks

9

No Entry before deciding Exits

10

No Complex Fee & Structure

3 Phases of Turtle's Quant Process

Turtle's Investment Approach

1. Selection & Research

Stock Selection Process

All Time High

Price

All Time High

Profits

All Time High Outperformance

Turnaround

Story

Pre-Decided

Exit

Key Trigger For Turnaround Businesses

Management / Financial Restructuring

Strategic Mergers or Acquisitions

Diversification into New Business Lines

Shift in Sectorial Demand

Regulatory and Policy Support

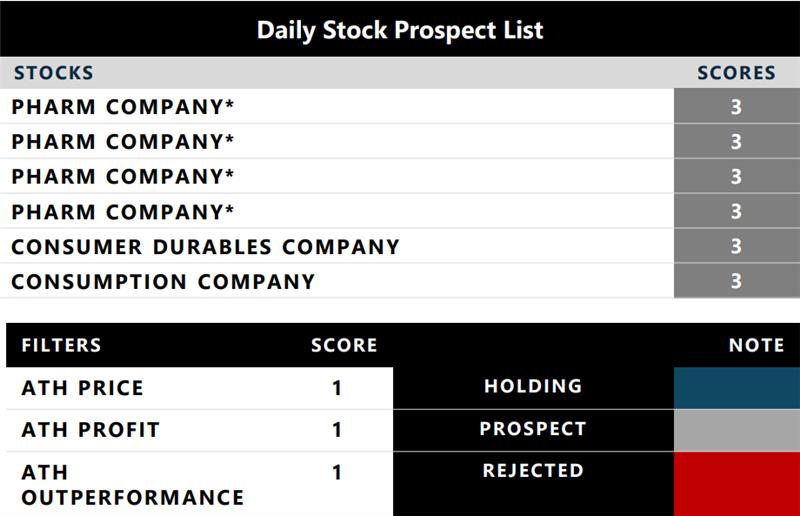

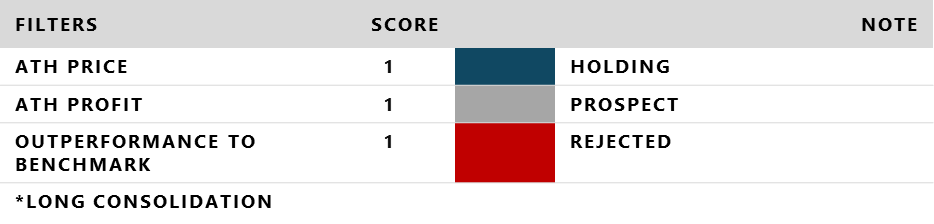

Turtle's Scoring Process

Daily ATH Stocks -02/5/2024

Simplify Quants

- All Time High Price

- All Time High Profit

- All Time High Outperformance

- Each Parameter accounts for 1 score

- We take Companies that score 3 for further research

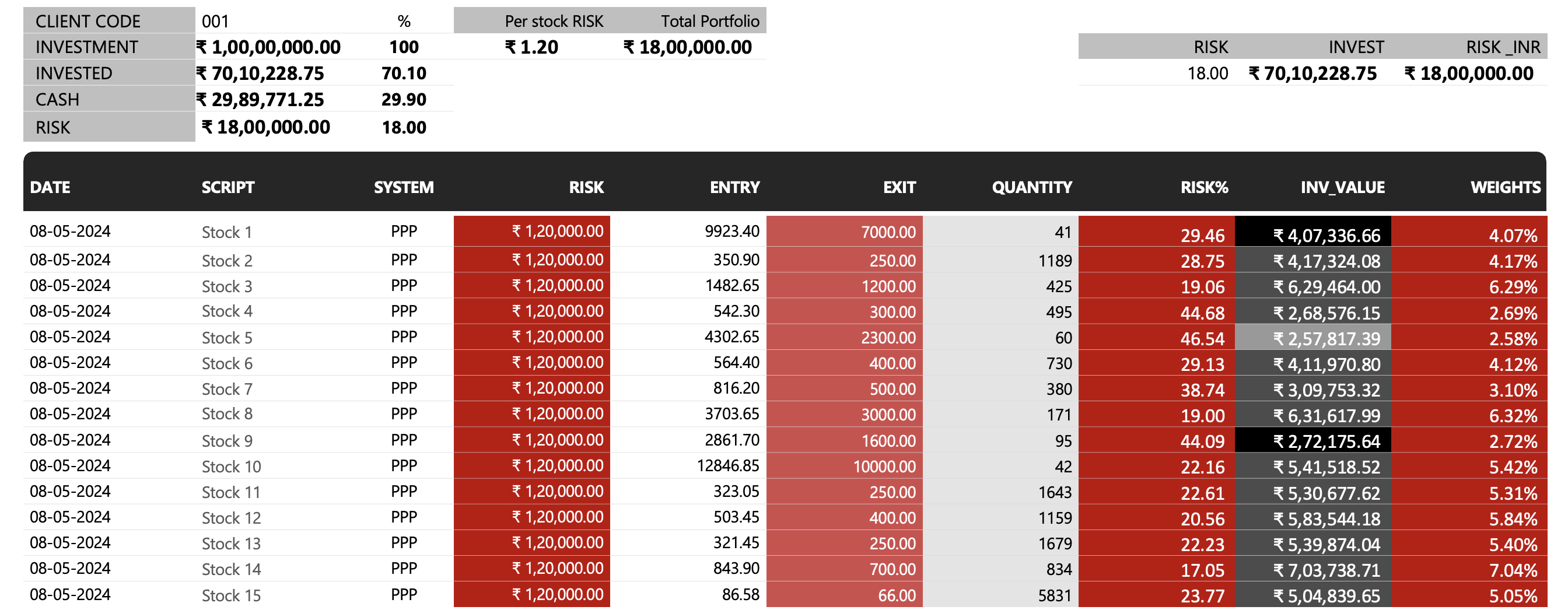

2. Allocation & Risk Management

Quantitative Allocation Process

Risk per Stock = Max of 1.2% of Invested Value

Deciding Exit before we enter

No Model Allocation Approach

Allocation based on the Risk Approach, is purely dynamic

Re allocation of stock is also based on Quants

Turtle Risk Management Framework for Allocation

Please note that this is sample data and is intended for informational purposes only. It does not guarantee any accuracy and should not be construed as an investment recommendation.

3. Holding Review

Turtle Revision Process

Reasons WHY you should NOT Invest with Turtle

If your investment horizon is lesser than 2100 Days, you should not invest.

If you can’t see your portfolio Down by 21%, you should not invest.

If you expect High returns before 1000 days of investment, you should not invest.

If you have taken loan/bank CC and doing investments to get the difference of returns, you should not invest.

If your love for Profits is higher than the Process or Quality of Business we have invested, you should not invest.

If you expect we will ALWAYS be in profits and ALWAYS outperform the benchmark, you should not invest.

If you can’t wait for last 20% of the time for 80% of the returns, you should not invest.

If you expect we will always outperform Interest rates every month, and every year there would be profits, you should not invest.

If you are going to continuously compare Our Portfolio with other or different Asset class, you should not invest.

If any of this point you don’t agree, on a serious note you should not invest with us.

Interviews

Portfolio Management Services

Wealth Mantra PMS

“Curated for Investors Looking for Great Companies with Low Volatility”

1 Year CAGR

28.04%

Minimum Investment

50 Lakhs

Growth Mantra PMS

“Curated for Investors Looking for High-Growth Companies with a Pinch of Volatility”

1 Year CAGR

22.00%

Minimum Investment

50 Lakhs

Profit Mantra PMS

“Curated for special ones looking for Customised Investment requests”

1 Year CAGR

19.07%

Minimum Investment

5 Cr.