Invest in India's

Turnaround Businesses

with

Turtle’s Advanced Quantitative PMS

Where Investment decisions are driven by Data & Processes,

not by Intuition & Judgements.

SEBI Reg No.: INP000006758

There are 2 Types of Investors in Market

Story & Intuition

Data & Logic ✅

Turtle Wealth PMS is for the one who believes in ‘Data & Logic’

USP

100% Transparent Quant Based Investment Process

Investment ONLY in Human Friendly Business

Bespoke Investment Solutions

Easy Access to Top Management

NO Exit Load &

LOCK IN

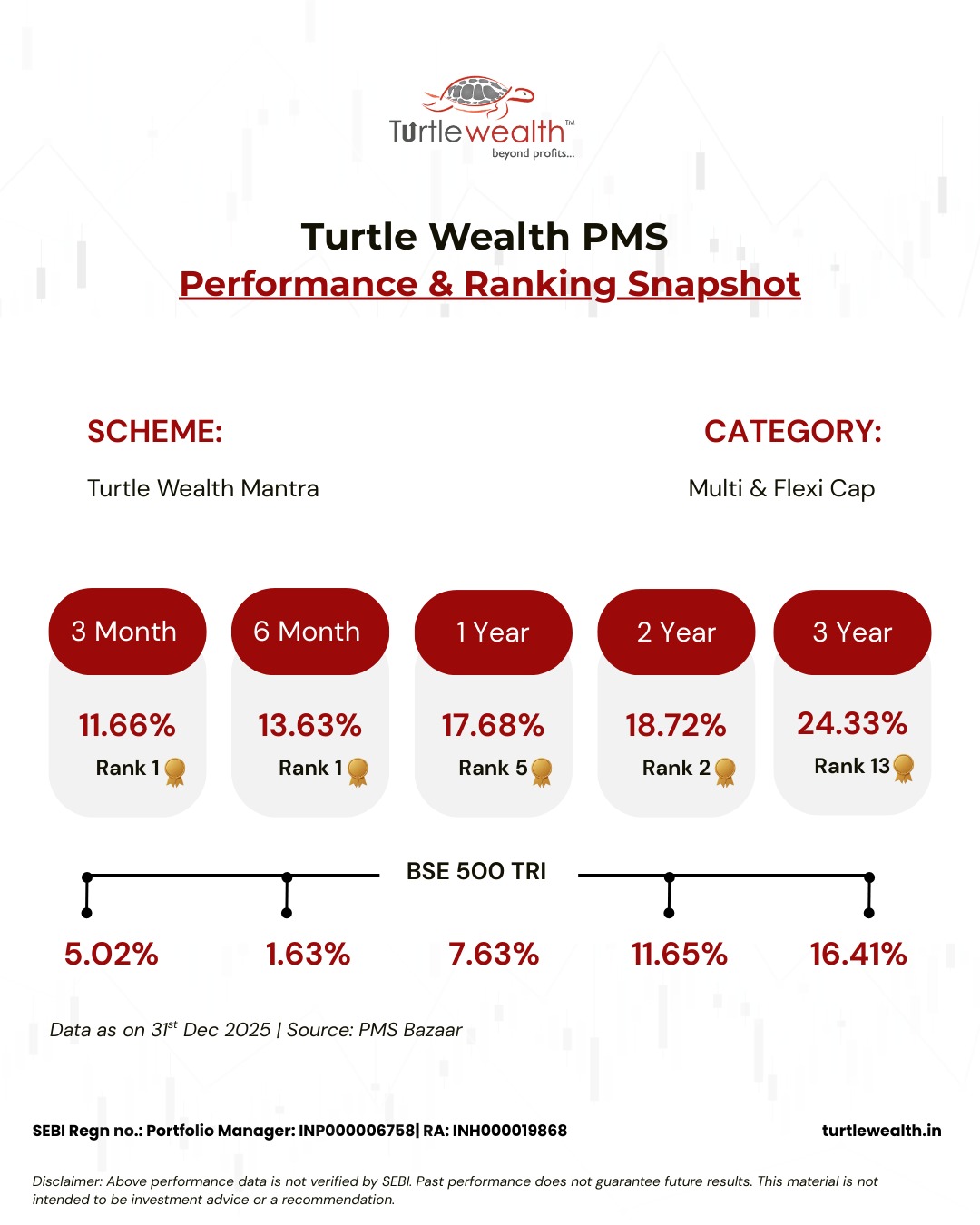

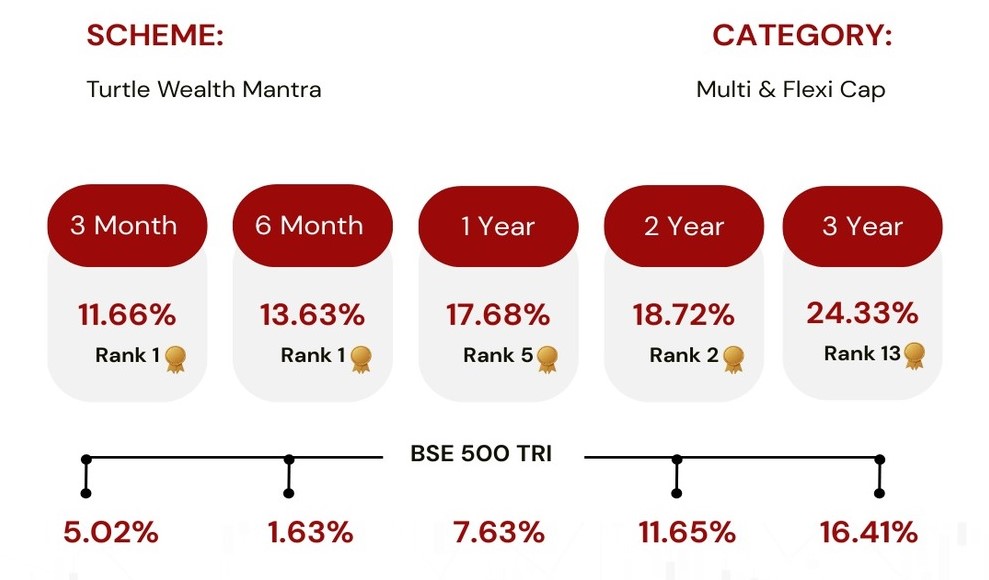

PMS Performance & Ranking Snapshot

11.66%

Rank 1 🏅

13.63%

Rank 1 🏅

17.68%

Rank 5 🏅

18.72%

Rank 2 🏅

24.33%

Rank 13 🏅

This material is not intended to be investment advice or a recommendation.

Product & Services

Portfolio Management Services

We endeavour to create 10x Wealth in 10 Years with a CAGR of 25%+ with our Turtle Quant Process.

PMS Advisory

Get Your Portfolio Reviewed by Experts. We Advise, You Decide.

Family Office Management

Appoint a CIO who works for the overall development of your Family Goals and Objectives under one Umbrella.

ExitMantra

We help INVESTOR to Add/Hold PERFORMERS Replace/Exit UNDERPERFORMERS

Our Wealth Creators

Product & Services

Portfolio Management (PMS)

We endeavour to create 10x Wealth in 10 Years with a CAGR of 25%+ with our Turtle Quant Process.

PMS Advisory

Get Your Portfolio Reviewed by Experts. We Advise, You Decide.

Family Office Management

Appoint a CIO who works for the overall development of your Family Goals and Objectives under one Umbrella.

Portfolio Management Services

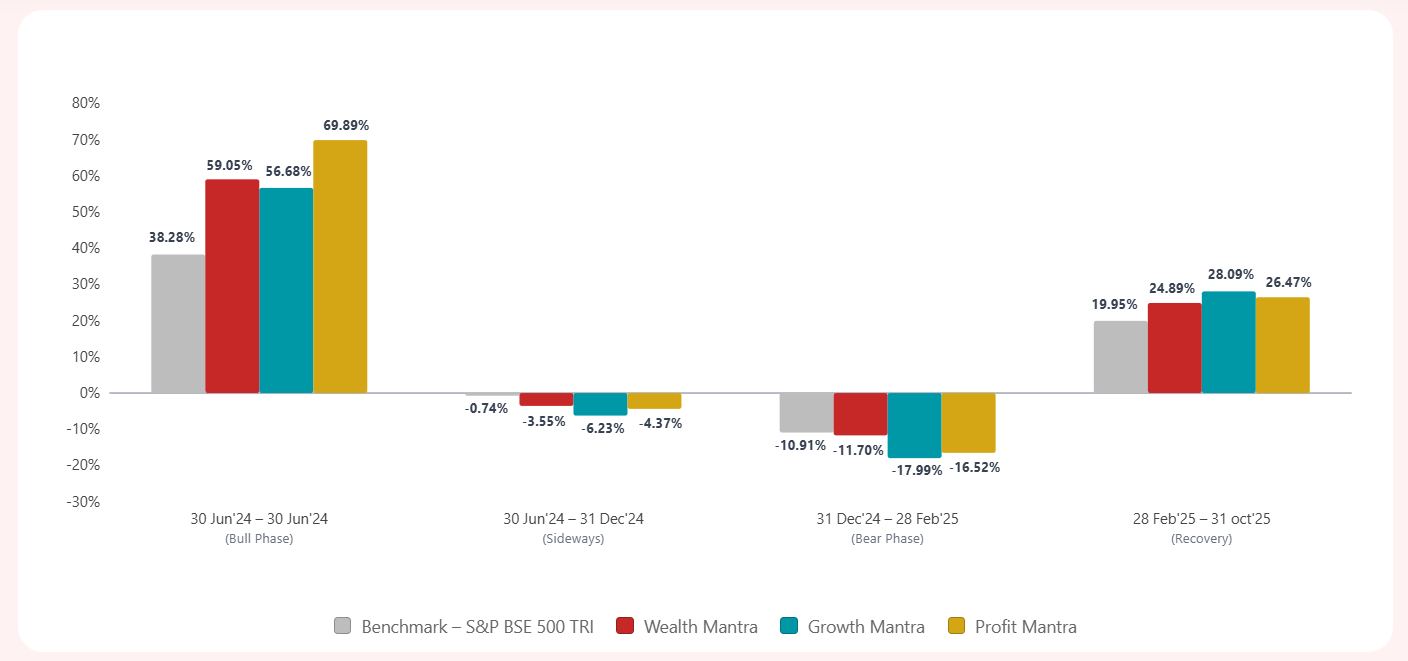

Wealth Mantra PMS

“Curated for Investors Looking for Great Companies with Low Volatility”

2 Year CAGR

21.51%

Minimum Investment

50 Lakhs

Growth Mantra PMS

“Curated for Investors Looking for High-Growth Companies with a Pinch of Volatility”

2 Year CAGR

16.22%

Minimum Investment

50 Lakhs

Profit Mantra PMS

“Curated for special ones looking for Customised Investment requests”

2 Year CAGR

26.01%

Minimum Investment

5 Cr.

Performance In Bull Phase Vs Sideways Vs Bear Phase Vs Recovery Phase

USP

100% Advanced Quant Based Investment Process

Investment in Human Friendly & ESG Compliant Business

Easy Access to Top Management

100% Focus + Ownership

Quarterly Review & Masterclass

Turtle's Quant Process

ADD

Super Performers

HOLD

Performers

EXIT/REPLACE

Under Performers

Turtle's Quant Process

Ethos of Turtle’s Quant Process

Made with 20 Years of Experience by Rohan Mehta (CEO & Portfolio Manager)

Extremely Simple and fuelled

with Speed

We know when to Hold, Run, Fold or Walk Away.

To Hold North, To Sell South & To Replace East & West Stocks

We Love our Clients Profit more than the Invested Companies

Our Wealth Creators

The stocks featured in the Our Wealth Creators section are for informational purposes only and do not constitute investment recommendations. Past performance is not indicative of future results. The stocks showcased may reflect a mix of realized and unrealized profits. Individual investors’ holdings may vary, and positions in these stocks are determined by our quant-based process in place.

PPP Investment ProcessTM

5 Crazy Features of Turtle's Quant Process

Turnaround

Business

Top 750 Companies of India

Outperformance of Stock to BSE 500

EXIT (Downside) is decided before ENTRY

Portfolio Allocation based on Risk Parameters

Investment only in Human Friendly Businesses

Animal Killing

Liquor - Tobacco

Leather Making

Hotels and Casinos

Non ESG Compliant

Reasons WHY you should NOT Invest with Turtle

If your investment horizon is lesser than 2100 Days, you should not invest.

If you can’t see your portfolio Down by 21%, you should not invest.

If you expect High returns before 1000 days of investment, you should not invest.

If you have taken loan/bank CC and doing investments to get the difference of returns, you should not invest.

If your love for Profits is higher than the Process or Quality of Business we have invested, you should not invest.

If you expect we will ALWAYS be in profits and ALWAYS outperform the benchmark, you should not invest.

If you can’t wait for last 20% of the time for 80% of the returns, you should not invest.

If you expect we will always outperform Interest rates every month, and every year there would be profits, you should not invest.

If you are going to continuously compare Our Portfolio with other or different Asset class, you should not invest.

If any of this point you don’t agree, on a serious note you should not invest with us.

Wisdom

Interviews

Our Channel Partners

Featured in