Human loves Gold, Especially Women and Govt. it’s one of the most liquid assets in the world, Gold has been one of the most favorite investments by Indians from centuries, we are also in top 10 Countries holding Gold Reserves.

As the Interest rates have seen the south side in Indian Markets, retail investors have found Gold to be one of the safest and easiest investment, that has a probability to beat the Interest Returns, with Safety and Liquidity in the Game, also Gold has always seen as a sense of prosperity and an emotional connect in Indian Families,

Interest rate going down, Gold Going up, and the economy in a tough time has yielded a great demand in Gold.

This day as gold has started inching up in the extreme North Direction and doing it all-time high, a lot of investors do call us asking 2 questions:

- Is this the right price to enter in Gold?

- Which is the best instrument to invest in Gold?

Let us understand what GOLD has done for us over past Decade

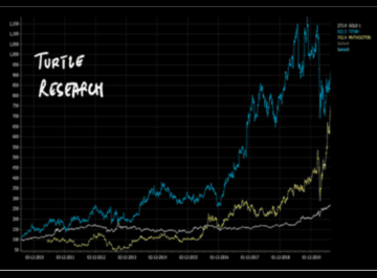

Gold has generated 2.70 time return in last 10 years, but the catch here is that from 2012 to 2018, good 6 years gold was at the same price, and there was nearly 0 Return (off course nobody would have hold equities if there is no return in 6 years, but gold we hold, right?)

We have many Gold investment options like:

- Buying Physical Gold – Jewelry

- Buy GOLD ETF/MF

- Buy Gold in MCX

- Buy Gold Sovereign Bonds

- Surprise!

Our whole approach when investing in other options than buying physical gold is where we can find security and more returns and that’s what is more imp.

As you see above 10 years data for Gold which is in White which has generated 273% returns, but the companies who do the business of Gold has given much more superior returns than Gold, Titan being one of the Undisputed brands in Gold business PAN India with the highest market share has given 921%, outperforming 3.30 times vs Gold and Muthoot holding the highest market of Gold Loan (which has practically near to 0 NPA Possibility) has generated 740% returns, outperforming by 2.70 times vs Gold.

Now why this has happened?

The simple reason is that Business Gets Valuation and that is the reason the Organized Leaders in the Gold business always will fetch higher valuations as the business of gold is bigger than the Business of Investing in Gold and they will, therefore, do much better in comparison to Investing in Gold.

So Next time when you or your family Questions should we invest in Gold? You know where you should contact

Investments in securities are subject to market risk and there is no assurance Or guarantee of the objectives of the Portfolio being achieved or safety of corpus. Past performance does not guarantee future performance. Investors must keep in mind that the mentioned statements/presentation cannot disclose all the risks and characteristics. Investors are requested to read and understand the investment strategy, and take into consideration all the risk factors including them financial condition, suitability to risk return profile, & the like and take professional advice before investing. Opinions expressed are our current opinions as of the date appearing on this material only.

Our Client, PMS, may hold the followed discussed securities, this blog is not an stock investment advise this is just for educational Purpose for more details visit: https://turtlewealth.in