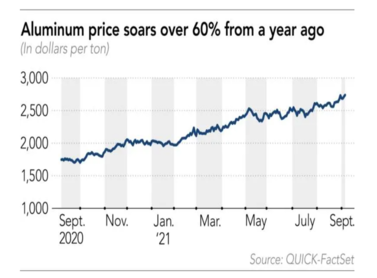

Aluminum prices have been rising steadily since the beginning of 2021 but in the past three weeks, the metal has become about 14 percent more costly, and touched $3,000 per tonne, the highest since 2008.

The behavior of a company’s stock usually reflects the performance of the underlying company. When a company performs well and generates earnings, its stock price rises, which further increases the stock’s demand, which further increases the stock price. This positive loop continues until the stock price reaches a point where it may correct for two primary reasons: the valuation or earnings peaks.

Short-Term vs. Long-Term Corrections

When the valuation peaks but earnings are still strong, the stock might enter a correction period lasting a few years. After this period, it can bounce back. These are short-term corrections, and one should not exit the company during this time. The resilience and strength of the underlying business often lead to a recovery, making patience a valuable trait for investors.

However, when earnings peak, the correction phase tends to be much longer. This extended correction indicates that the company needs time to restructure, innovate, or find new growth avenues. When a company’s stock price then again reaches and surpasses its previous high, it signifies that the company has entered a new era and is now more capable of generating higher profits.

The Indian Market’s Emergence from Prolonged Correction

Consider if the entire Indian market has emerged from a prolonged correction. By observing the price trends of major listed companies, many have reached new highs, surpassing their previous multi-year highs, and entered a structural bull run in the last two to three years. The indices also reflect this trend, signifying a broader market movement.

What Does This Signify?

It shows that we are in a structural bull market. Companies from various sectors are demonstrating growth. Examining earnings reveals that, in just three and a half years, the corporate profit-to-GDP ratio has almost doubled. In the Nifty 500, nearly 170 companies have entered a structural bull market after long periods of consolidation (five or more years where the price went nowhere). This suggests that one-third of the Nifty 500 companies have experienced a turnaround.

What to Do in a Structural Bull Market?

In a bull market, at every point, you may not believe that prices can go up from here, and the market continuously proves you wrong by going higher. As proud price followers at Turtle, we follow the price without any bias. This approach has led us to be part of some of the best-performing multi-bagger stories, which we have experienced with public money.

- Always Be in the Game: In every market condition, stay invested because you don’t know when and where a big move will come. According to RJ’s sayings, when you are less confident, be 100% invested in the market, and when you are confident, be more than 100% in the market.

- Don’t Miss the Best Days: Missing some of the best days can significantly change your returns. Data supports that missing these days can drastically affect your overall returns.

- Don’t Focus on Downside, Embrace the Uncertainty of Unlimited Upside: To participate in the market, you need cash, courage, and conviction. Cash and conviction you can get easily, but courage is something that comes from practice. If you only see how much you are going to lose, you can never enjoy the upside. Loss aversion makes you cut your profits and stay in loss. Instead, when you realize that the upside is unlimited and if you are right, you win by multifold. Focusing on unlimited upside gives you the courage to participate in the market.

Conclusion

Navigating a bull market requires understanding how stock prices reflect company performance and broader market trends. Companies entering a bull phase demonstrate strong performance, creating a positive cycle of rising stock prices and increasing demand. While corrections are inevitable, resilient businesses often recover and reach new highs. The recent emergence of the Indian market from prolonged correction highlights significant growth potential, with many companies reaching new highs. Staying invested, embracing market uncertainty, and focusing on potential upside rather than downside can lead to substantial returns. By following market trends without bias, investors can capitalize on the continuous opportunities presented by a structural bull market.

– Jaymin Shahukar

Quant Research Analyst

Investments in securities are subject to market risk and there is no assurance Or guarantee of the objectives of the Portfolio being achieved or the safety of the corpus. Past performance does not guarantee future performance. Investors must keep in mind that the mentioned statements/presentation cannot disclose all the risks and characteristics. Investors are requested to read and understand the investment strategy, and take into consideration all the risk factors including their financial condition, suitability to risk return profile, & the like, and take professional advice before investing. Opinions expressed are our current opinions as of the date appearing on this material only.

Our Client, PMS, may hold the following discussed securities, this blog is not stock investment advice this is just for educational Purposes for more details visit: https://turtlewealth.in