Investment Objective

Endeavour to consistently generate ALPHA by investing in India’s Turnaround Businesses where Emerging Leadership & Growth are in common with Turtle’s QUANT-Based Investment Process.

Driven by data, our investment strategy minimizes human bias through a structured, objective process.

Factsheet

Investment Theme

Tailored for first-time PMS investors seeking exposure to high-potential emerging companies with moderate to high volatility, aiming to build long-term wealth.We continuously select, allocate, and review investments through our trademark PPP (Price, Profit, and People) investment process.

Market Capitalization

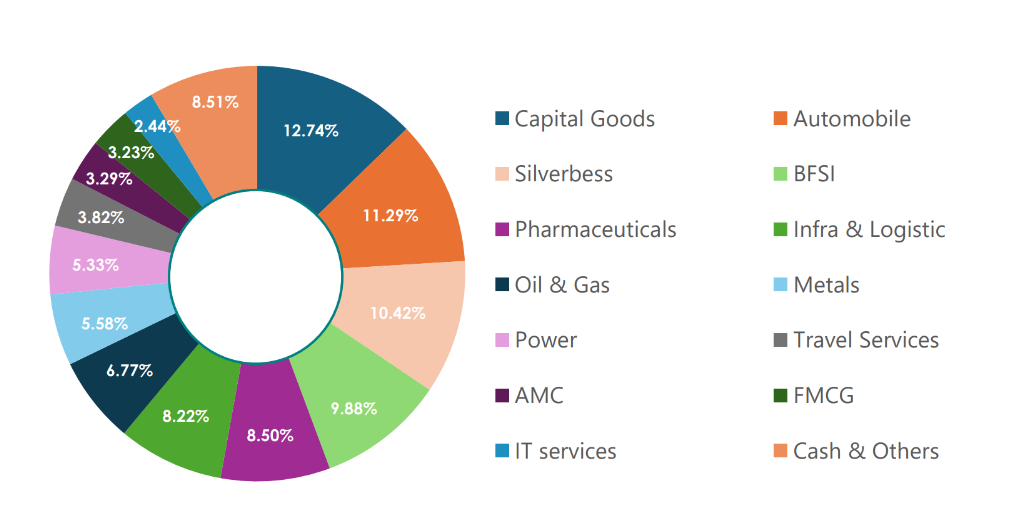

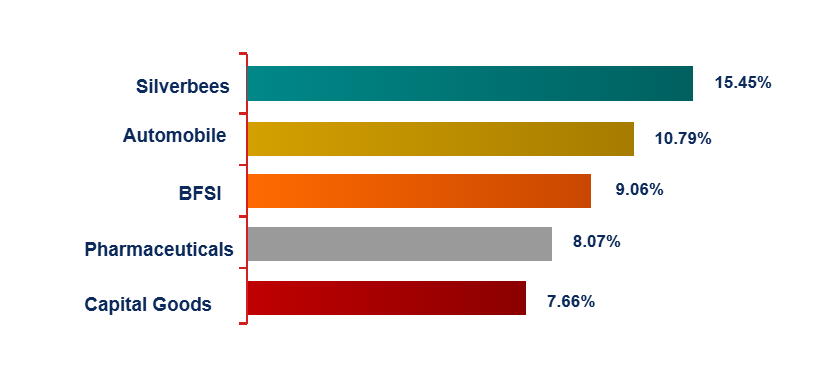

Sector wise allocation

No Data Found

Performance Chart

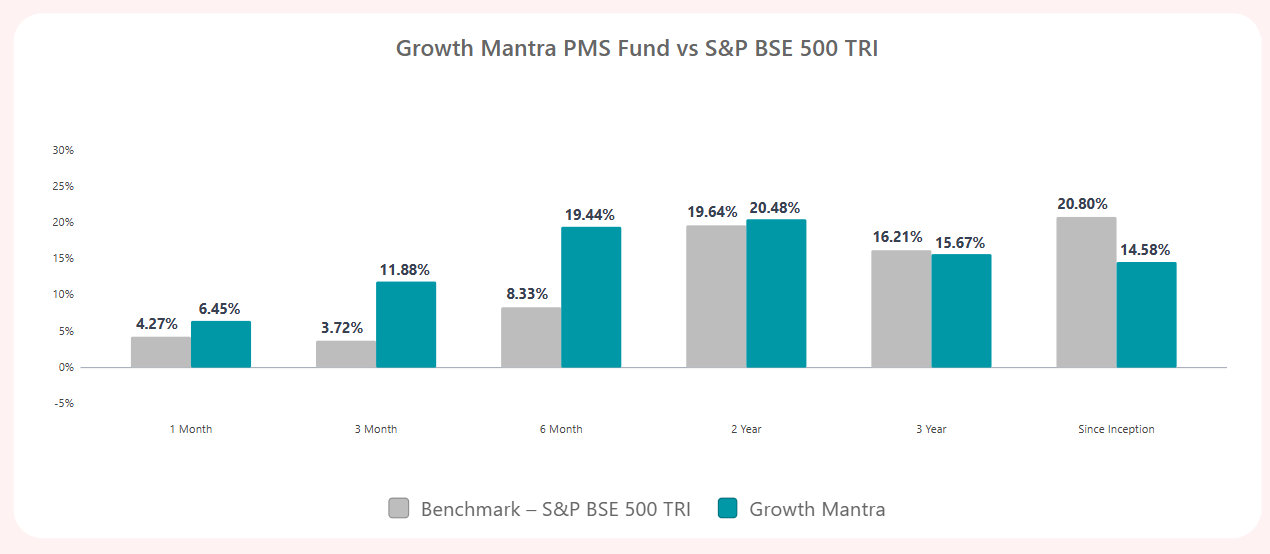

Growth Mantra PMS Fund vs S&P BSE 500 TRI

No Data Found

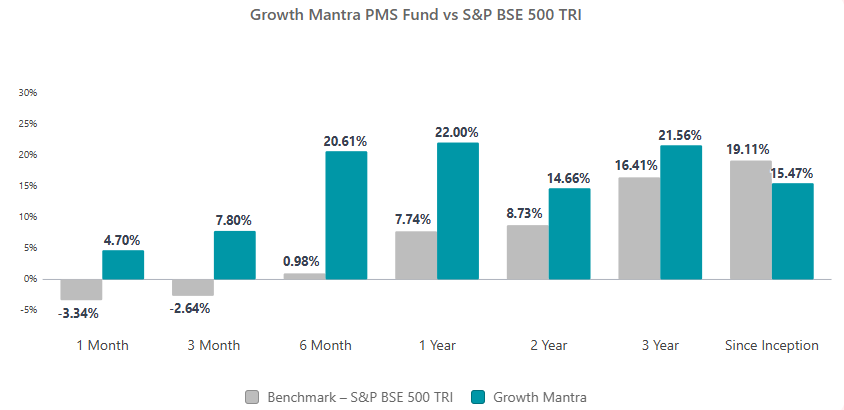

Growth Mantra PMS Fund vs S&P BSE 500 TRI

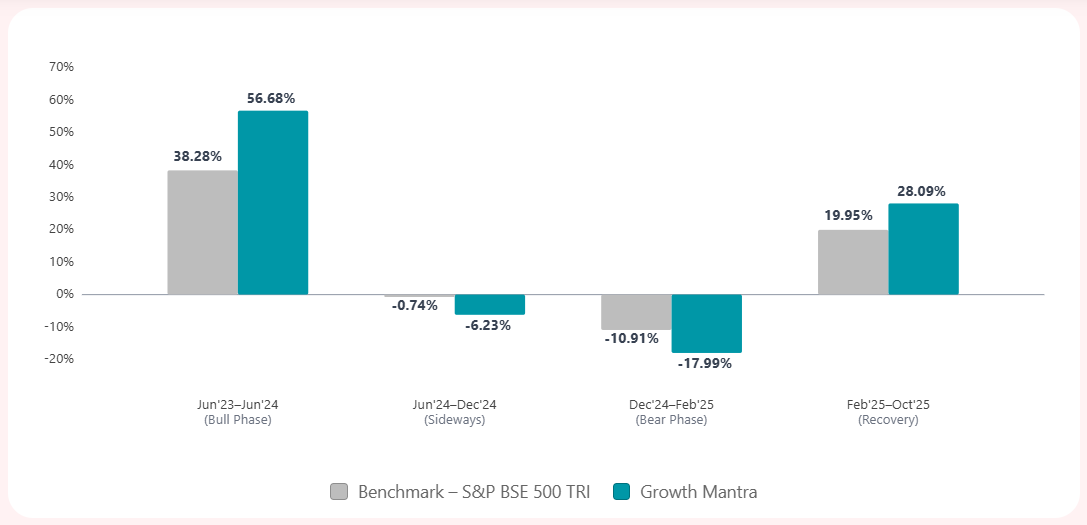

Performance In Bull Phase Vs Sideways Vs Bear Phase Vs Recovery Phase

Growth Mantra PMS Fund vs S&P BSE 500 TRI

No Data Found

PMS Fund details

Inception Date

October 2020

Category

(Small & Mid Cap)

Benchmark

BSE 500 TRI

Minimum Investment

50 Lakhs

Investing Approach

Quant Based

Fund Manager

Mr. Rohan Mehta

Fund Manager

- MBA with 20 Years of Experience in Equity Markets.

- Proficient in Quant Investing, generated more than 21% CAGR Returns

- Managing more than 700+ Cr. Funds

- GOAL: To be GOAT in Quant Investing

- Author of 212° The Complete Trader

- Passion: Spirituality, Stocks, Squash & Vision Boards

- BMI: 23.90

"Don't SELL North, Don't HOLD South, REPLACE East & West!" TM

Fees Structure

Option 1 – Fixed

Fees

2% Fixed Management Fees on

Average Net Asset Value Option 2 – Hybrid Fee Model

Fixed Fee at 1% per annum on AUM and 10% Profit sharing above the Hurdle Rate of 10% on every anniversary date, subject to High Water Mark.Option 3 – Hybrid Fee Model

Fixed Fee at 0% per annum on AUM and 20% Profit Sharing above the hurdle rate of 8% on every anniversary date, subject to High Water Mark.Option 1 – Fixed Fees

2% Fixed Management Fees on

Average Net Asset Value

Option 2 – Hybrid Fee Model

Fixed Fees at 1.00 % per annum on AUM and 10% Profit sharing above the Hurdle Rate of 10% on every anniversary date subject to High Water Mark.

Fees Calculator & Illustration

Custodian & Auditor

Custodian

Orbis Financial Corporation Ltd.

Auditor

SecMark Consultancy Ltd.