In the world of investing, falling stock prices often feel like opportunity knocking. A ₹100 stock falls to ₹60 — and suddenly it feels like a bargain. Many investors react instinctively: “Let’s buy more and lower our average cost.”

This strategy, known as averaging down, is one of the most common reactions to drawdowns — but often, it’s also one of the most dangerous.

Just because a stock is cheaper than before doesn’t mean it’s better value. History and research both show:

- Averaging down works only if the company is fundamentally strong.

- If the business is broken — bad earnings, high debt, or poor leadership — buying more simply means doubling your risk.

What seems like a discount can quickly become a value trap.

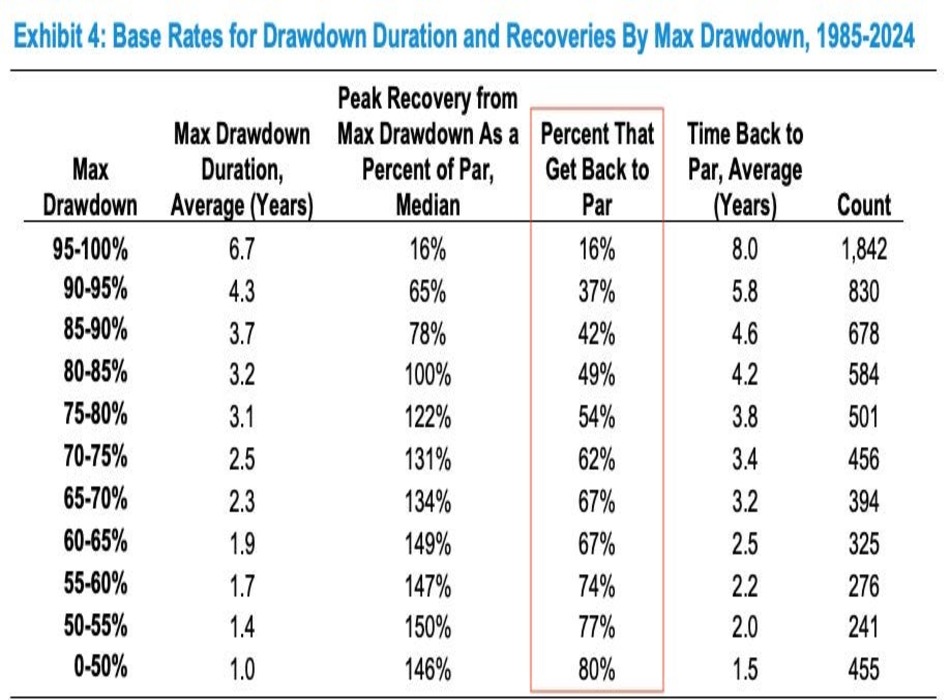

The chart shows a critical pattern:

The deeper the fall, the lower the odds of recovery. Only 1 out of 6 stocks that crashed 95% or more ever made it back to their old highs.

And the time taken to recover?

- Mild corrections (<50%) recover in ~1.5 years.

- Deep crashes (>90%) take 5–8 years, if they recover at all.

Averaging down isn’t always wrong — but it’s not always right either.

It works well only under very specific conditions:

- The business is strong, with healthy fundamentals.

- The stock has fallen due to market sentiment, not internal collapse.

- You have clarity in your investment thesis and conviction in the company’s future.

Even legendary investors average down — but only in high-quality businesses, not hope trades.

The real edge lies in knowing what to HOLD, what to REPLACE, what to EXIT, and when to ADD— with data and discipline as your guide.

That’s where the Exit Mantra can guide you. It’s not just a checklist — it’s a mindset. A clear framework to evaluate every position, not emotionally but objectively.

Because in the markets, price is just what you pay — value is what you truly get.

Regards,

Kirti Golicha – Research Analyst

Disclaimers and Disclosures

SEBI Reg. No: INP000006758

Investments in the securities market are subject to market risks, and there is no assurance or guarantee that the objectives of any investment portfolio will be achieved. Past performance is not indicative of future results. Above performance data is not verified by SEBI. It is important for investors to consider their financial condition, risk tolerance, and investment objectives before making any investment decisions. The content provided by the Company, including but not limited to reports, research materials, and presentations, is for informational purposes only and should not be construed as an offer to buy or sell securities, or a solicitation of an offer to buy or sell securities, in any jurisdiction where such an offer or solicitation would be considered illegal.

For Detailed Disclaimer: https://turtlewealth.in/disclaimer/