In 1994 Surat was effected by Plague (which has much higher mortality ratio comparing to corona), nearly 60% of the population left surat, the total death was 52 which was much lesser than the fear, at that time there were no WhatsApp, email, social media, etc. still, humans have proved over a period that “We worry more of Diesease than the Death”, we do everything in excess when we like a certain business we give excess valuation to the stock like the business will never see a downturn for 1- 2 decade same way when we see panic we sell our stocks like the business will end up tomorrow, we have seen both of this emotion in last 30 days.

It is said, you are known in markets by the Seller Circuits and the number of crises you have witnessed & surpassed, this is my 5th Seller Circuit and believe me, all came without informing, all 5 were sharp, unprecedented and the most common was when you see in hindsight all were a great opportunity of learning not to do the same mistake which was done in last seller circuit, this time it took 12 years to give us that hit, every time the reasons were different but the human behavior was the same, there was one common factor and that was Big IPO, this time it came out from nowhere, and till today no one knows when it will end, but from my learning of last 1.5 decade this is are the basic factors that I am extremely confident about:

- When a Stock breaks more than 42% from its highest peak, 92% of the time it will never come back to its Peak! (Turtle Research)

- The biggest rally will come when mass starts to sell and get out rather than buying more (still I am getting calls what to buy)

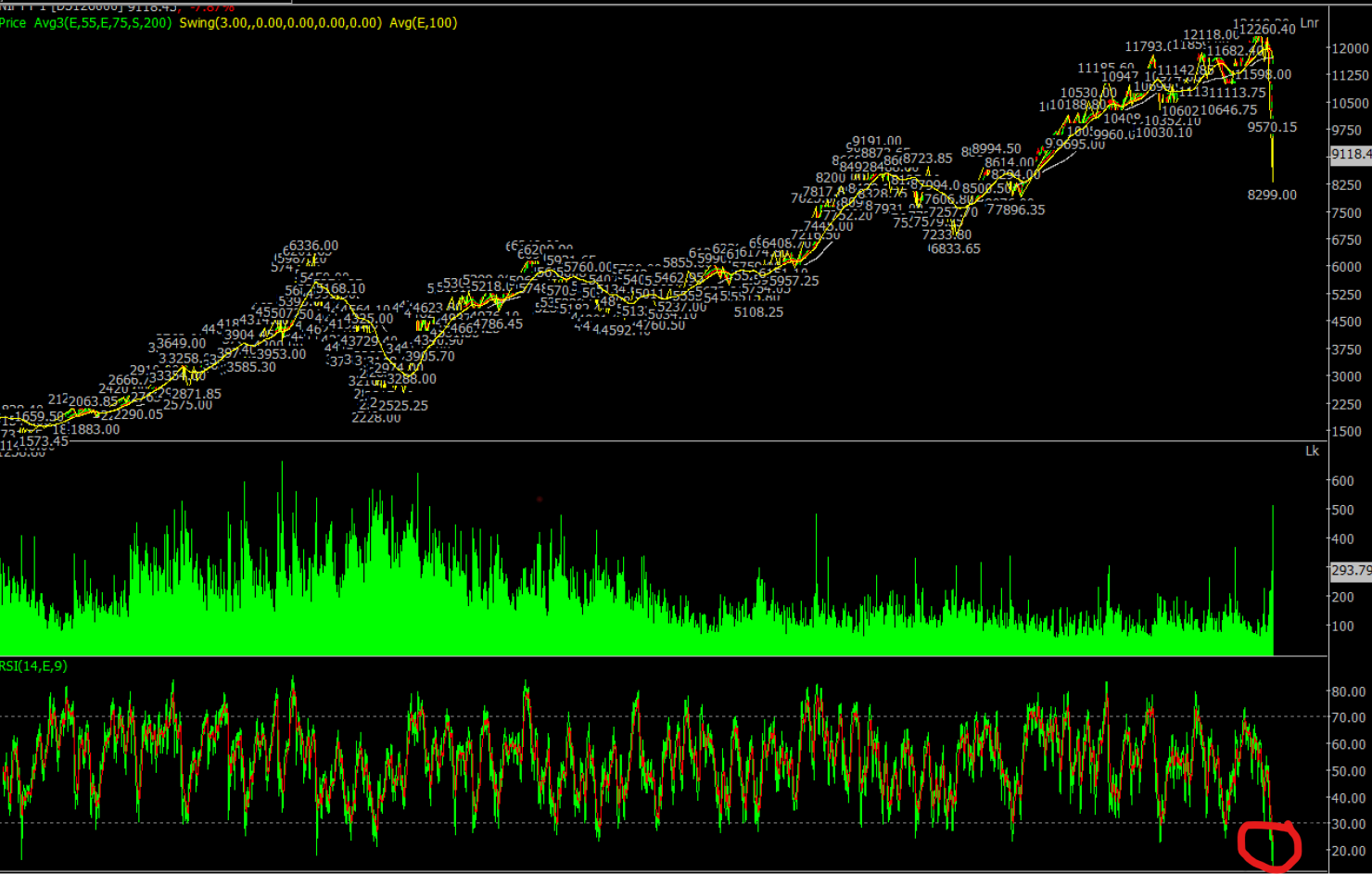

- This is the 1st time from 2014 after the market crossed 2008 highs of 6400 NIFTY it has entered in bear zone.

If the stock breaks the lower circuit lows (i.e. on 13th March) and closes below it with its 200 DMA is negative are seriously bearish stocks.- The stocks which will do a new ATH in the current scenario will be “Dabbang”!

- A great business will recover faster than the mediocre businesses

- In this type of market, you come to know how strong is your EQ (Emotional Quotient) and your IQ, most of the time EQ takes over IQ and mass exits at the bottom.

- Where markets will go no one knows, so don’t try to predict markets, and ask pundits about what will happen next, rather just focus on the learning and executing.

- Buying 20% now and in parts, parts are one of the most mediocre strategies, if you are confident you buy, if you aren’t don’t, there is no HALF Pregnancy!

It’s the 1st time in History that NIFTY has fallen 16 days consecutively without closing higher than the previous day.- The strength of the NIFTY is at the lowest level from its Inception (1990).

God Bless us all!

Regards

RoMe!