In the Financial Markets we are much more aware with the term called “Black Swan” – an unpredictable or unforeseen event, typically one with extreme consequences, I have read almost all the Black Swans that has happened from the Tulipomania from 1600 till date, but what happened recently it has never happened in the History of Financial Markets.

The market does excesses, and all the previous Black Swan was the result of Excess Greed, Leverage and lack of Discipline, but this one is just different and something which was never in control.

So we all have this famous saying how much a stock or commodity can go down? 0 that’s it right? So many of the Retail investors buy penny stock as they think the worst it can do is to 0, nothing more than that, same in Options maximum premium can erode to 0, if 2 months back If i would have told you that a Commodity or a stock that can go below 0, you would have thought I am coming from a different planet all to gather right?

But that happened and I believe it was the “Mother of Black Swan”, due to privacy issue I am not naming the Client and the real quantity, but this has happened in real, I am sure we will learn the biggest lesson of our life from this blog!

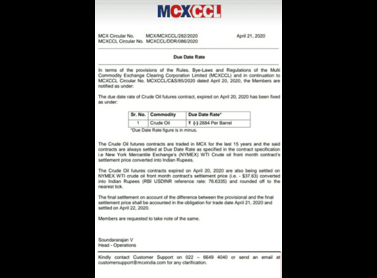

Lets us name the Client Mr Jain, he bought 100 Contracts of Crude oil Futures at an average price of 1000 Rs. i.e. 10000 Crude (100*100) valued to 1 Cr. = Total Value of the Contract, as per our basic common sense the maximum loss of Mr. Jain would be 1 Cr. Only, but this time something happened where the whole Financial Industry was stunned, the exchange gave out the closing of the contract in Negative Value, which is unprecedented, so Mr Jain who had 1 Cr. Of Maximum approach had a loss of 1 Cr. + 2.8 Cr. (2884*10000) = 3.8 Cr., now no exchange nor any broker have a Risk Management of Negative Pricing, the broker would have maximum earned 1 Lac Rs. of Brokerage from the Trade that too Maximum, now it has ended up In a bad debt of 3 Cr., now the fight will go for years!

Most of the Investor/Trader bought Crude Futures on the logic of Catching the Falling knife, crude has decreased so much, and it may not go down more as it is the essential commodity of the world, as it will be a good short term trade for few bucks, also it is lock down so can make few quick money by trading on tho this, as the axiom says “Commodity prices cant go to Zero”, there are various reasons why Crude went in negative territory, but the fact is that buyer lost money that too below the gravity and that sums up for all!

- Never say Never, anything and anything is possible in the Financial World!

- Risk Management should be the most important virtue in the place of Return Management.

- Never hold stock on a view that it is near to zero, what the maximum loss?

- Ask for the Maximum Risk In your portfolio vs. What’re the maximum Returns?

- Don’t catch the falling knife, most of the time you will be injured, this time some one was killed!

Regards

RoMe!