Date: 23.03.2023, Money Control on Market View for Next 2-3 Years, BEGINNING OF THE NEW BULL markets

24-09-2024 Money Control - Now, rich individuals seek more quant-based strategies for their PMS investments

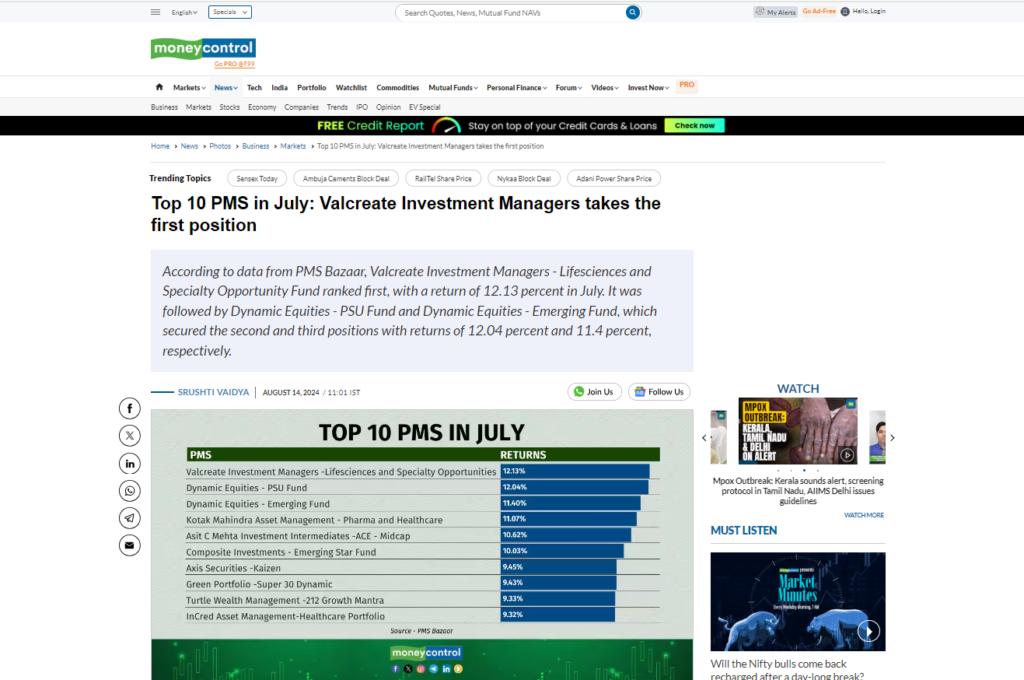

14-08-2024 Money Control - The top 10 Portfolio Management Services (PMS) in July in terms of returns delivered between 9-12 percent.

The top 10 Portfolio Management Services (PMS) in July in terms of returns delivered between 9-12 percent. According to data from PMS Bazaar, Valcreate Investment Managers – Lifesciences and Specialty Opportunity Fund ranked first, with a return of 12.13 percent in July.

22-12-2023 Dalal Street Investment Journal - Answering the million-dollar question: When to sell? - Rohan Mehta.

In a market reaching all-time highs, with the NIFTY 500 showing a 10 per cent increase in the current quarter and a remarkable 22 per cent in the current calendar year, investors find themselves torn between excitement and apprehension.

31-8-2023 Money Control- This analyst firmly believes Nifty will reach 21,000 by end of current fiscal year - Rohan Mehta

Rohan Mehta, CEO and Portfolio Manager of Turtle Wealth, is certain that the Nifty50 will reach 21,000 by the end of the fiscal year.

11-7-2023 Money Control- Why this fund manager believes market yet to reach its peak, sees Nifty at 21,000 this year Ft- Rohan Mehta

The current volatility in equities is likely to persist for the next 2-3 months in the backdrop of the issues worldwide and events unfolding at Adani Group, according to Rohan Mehta of Turtle Wealth Management.

27-6-2023 Unlocking the Power Of Compounding Ft- Rohan Mehta Decodes The Rule Of 72, 144, 144

Compounding works by growing your wealth exponentially. The Rule of 72, 114, 144 will help you to make better financial plans. Watch this video to know more about the power of compounding and rules of investing.

Date: 23.03.2023, Money Control on Market View for Next 2-3 Years, BEGINNING OF THE NEW BULL markets

I believe this is one of the best times to accumulate great business, the stock doing all-time high, with the best QoQ and YoY numbers, with a turnaround story will make the best returns of all,” Rohan Mehta, CEO and Portfolio Manager at Turtle Wealth, says in an interview to Moneycontrol.

Date: 14.03.2023, ETMarkets on BIG Bull Market above 16100 NIFTY 500.

The current volatility in equities is likely to persist for the next 2-3 months in the backdrop of the issues worldwide and events unfolding at Adani Group, according to Rohan Mehta of Turtle Wealth Management. But beyond this volatility, Mehta does see a big rally for equities.

Date: 3-4-2023, Article on logistics in ETWealth by Sachi Shah

India’s logistics sector has always faced elevated costs as it is skewed towards the inefficient roads segment. Logistics cost as a percentage of GDP is around 14%. Such costs are 8-10% in developed countries.

Date: 17-4-2023 Article on How Balanced Advantage Fund in Mutual Funds can be helpful in asset allocation and managing valuation risk.- Hardik Gandhi

As frothy valuations of many stocks have corrected, fund managers are increasing equity exposure in balanced advantage funds, especially in high-quality companies at reasonable prices. This indicates fund managers’ confidence in the market’s growth prospects and the potential for higher returns.

Date :30-04- 2023- Market View on Money Control, Portfolio Managers sees the value in HDFC Bank

We are bullish on the banking side and the rerating is possible in the companies where there is deep value,” Rohan Mehta, Founder and Portfolio Manager at Turtle Wealth says in an interview with Moneycontrol.

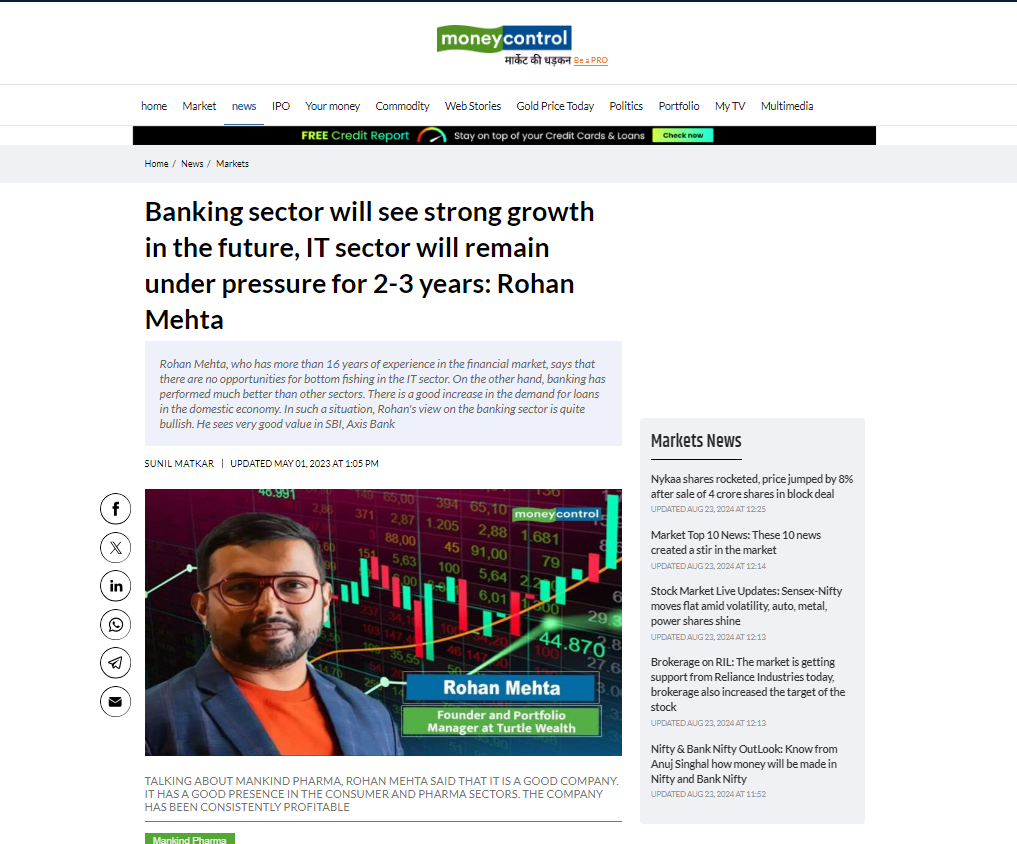

Date: 01-05-2023, View on Banking Sector Article published on Money Control.

Rohan Mehta, who has more than 16 years of experience in the financial market, says that there are no opportunities for bottom fishing in the IT sector. On the other hand, banking has performed much better than other sectors.

Date: 29-05-2023 ETMarkets PMS Talk: This Rs 400 cr fund manager decodes methodology of 10x return in 10 years

“Turtle PMS is one of the most curated Strategies Quant PMS in India, we follow a unique model of buying a turnaround business, where the ‘value’ is higher than its ‘price’,” says Rohan Mehta, CEO & Fund Manager of Turtle Wealth.